One of the most common problems in a surgical procedure is the risk of an

object being left inside the patient after the surgery is complete. Half of the

times this happens, what is left behind is either a sponge or a towel. Patient

Safety Technologies (PSTX) developed a simple, effective and affordable solution for this problem,

and is set to reap the benefits of the increasing awareness and adoption of its

system.

The problem

Before and after a surgical procedure, the

surgical staff will count all the items (tools, sponges, etc) that are used

inside the patient. They do this to avoid any of these items from being unintentionally left inside the patient after the surgery is finished. Surgical

sponges prove to be one of the most difficult and time consuming items to

account for and are one of the most common items unintentionally left on the

wrong side of the stitches after a surgery. This happens due to a number of

contributing factors:

- On average, surgeons use about 20 sponges per procedure, although in more complicated surgeries this number increases significantly

- When in contact with blood, sponges become red and blend with the background, making them difficult to spot

- In long surgeries the nurses may change (shifts)

- Human factors such as exhaustion, lack of tools necessary to aid in producing an accurate count and a chaotic environment around the operating table, are also pointed as the main reasons for this problem

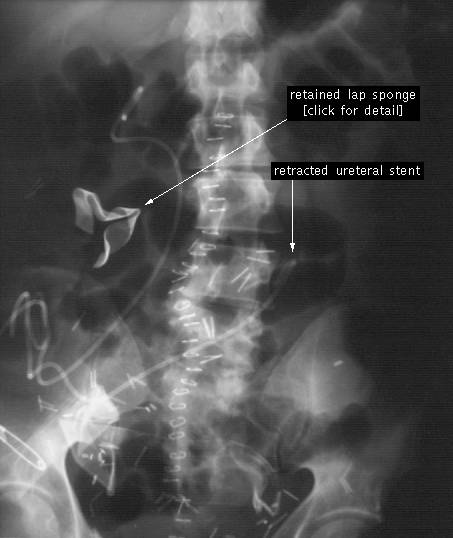

Below is an X-Ray showing a retained-sponge. I

will spare you the image of what these sponges look like after they have been

inside the patient for several months …

PSTX estimates that there is a sponge left

inside a patient for every 8'000 procedures, and that in the US this problem

happens 4'000 times per year (11 times / day). Because hospitals are not

required to report the incident if the patient suffered no major permanent loss

of function other sources have different estimations. Even so, most estimates I

came across are similar to PSTX's.

Hospitals are very careful in avoiding this type

of "never-events", in part because of the economic costs involved:

legal & medical costs associated with a new surgery to remove the object

plus medical attention to the patient. The company estimates that the average

cost of each incident is $413k, which means the retained-sponge problem

represents an $1.7bn avoidable cost for the US health-care industry every year.

The company divides its cost per incident as follows: $345k in legal costs and

$68k in medical costs (estimates come from the annual benchmark report for

malpractice).

Besides this there is also the loss of

reputation for both the hospital and clinician, as well as any applicable

government fines.

The Solution offered by PSTX

PSTX patented a system to eliminate the incorrect counting of sponges,

which is based in reducing human error involved with the manual counting of

sponges & towels. The system consists of uniquely identified surgical

sponges & towels that are called Safety-Sponge, and a handheld

device called the SurgiCounter, which scans and keeps track of the sponges and

towels. There is also a software application to document everything. Here is

how it works:

- Safety-Sponge: Each surgical sponge & towel has a soft flexible label with an individual unique identifier (QR code)

- SurgiCounter: Before being used each sponge is scanned by a handheld device called SurgiCounter. After being taken out of the patient the sponge is scanned again. The handheld device will tell the user how many sponges are in use and how many are still inside the patient, thus eliminating human error

- SurgiCount 360: Finally there is an application called SurgiCount 360 that works as a back-office software, providing the hospital with a documentation and compliance tool.

The system has been successfully used in more

than 7 million procedures, with more than 150 million sponges being safely

removed from patients. Most important, to date there has been no sponge left

behind.

The hospitals that adhered to the Safety-Sponge

system have thus avoided a total of 875 sponges that otherwise would have been

left inside patients (7Mn / 8k), thus avoiding $360 million in related legal

& medical costs (875 x $413k).

The Market Opportunity and Market Participants

PSTX estimates that there are 32 Mn surgical

procedures each year in the US where their products could be used. With the

average revenue per procedure for PSTX ranging between $12 and $15, this means

the US alone represents a $380 Mn to $480 Mn revenue opportunity. The company

also estimates that there is an addressable international market twice the size

of the US.

Currently there are three companies offering

solutions to prevent the retained-sponge problem:

- Patient Safety Technologies with the Safety-Sponge / Surgicount System explained above

- RF Surgical offers the Low Frequency RF Scanning, which uses a low energy radio frequency signal capable of locating misplaced surgical items fitted with an RF tag prior to wound closure

- Clearcount offers The ClearCount Platform, which uses a small, passive Radiofrequency Identification (RFID) tag securely embedded in each sponge.

Of course each of the companies will tell you they are the leaders and

their system performs much better than those of its competitors, but after

reading a couple of studies, it is clear that PSTX's system clearly dominates the others due to its

low cost and effectiveness.

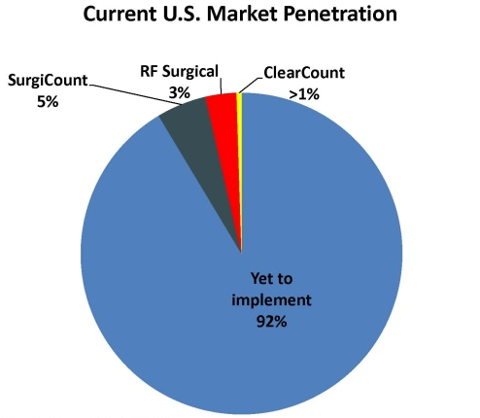

US Market adoption of any of these 3 systems is

still in its infancy. Surgicount has the highest market share with 5%, followed

by RF Surgical and Clearcount at 3% and <1% respectively. This still leaves

more than 90% of the market to be explored, not to mention international

opportunities.

The adoption of measures to prevent retained

sponges is expected to increase because of: 1) increased regulatory pressure,

with Medicare stopping its payments (to hospitals) related to procedures to

extract retained sponges and with most states are now fining hospitals for each

incident; and 2) peer pressure, with hospitals that haven't yet adopted a

system to avoid retained-sponge having no excuse vs. hospitals that have

already adopted the system. Besides there is the financial incentive already

mentioned (legal & medical costs).

The graph below shows PSTX's the customer base.

As of their last update, there are an additional 17 customers with a signed

contract, pending scheduled implementation. Despite the growth really picking

up during 2012, if you look at the big picture, PSTX really has only scratched

the surface.

The majority of the growth in 2012 was due to

PSTX signing an agreement with the second largest hospital operator in the US

that added 130 net customers.

Production and Distribution & Implementation

PSTX uses A Plus International, a Chinese manufacturer

of disposable medical and surgical supplies, as its exclusive manufacturer. The

company first entered into an exclusive supply agreement with A Plus in 2005,

and this contract was renewed in May of 2008 for 10 years. The contract grants

A Plus the exclusive, world-wide license to manufacture and import the sponge

and towel products used in the Safety-Sponge System. A Plus manufactures the

products in its FDA approved facilities (mainly in China) and also provides

packaging, sterilization, logistics and related quality and regulatory

compliance support. The company (A Plus) has agreed not to manufacture, import

or otherwise supply any bar coded surgical products for any other third party.

The pricing of the contract is negotiated annually to reflect changes in

manufacturing costs (ie. Cotton, Chinese Fx and labor)

In 2006 PSTX signed a contract to use Cardinal Health (CAH) as its

exclusive distributor for the US, Canada and Porto Rico. The agreement has been

renewed several times, and now runs until Dec. 2015. The commission paid to

Cardinal is on average 20% of revenues.

A Plus and Cardinal Health are also shareholders

of PSTX, and Mr Wenchen Lin (founder and significant owner of A Plus) is a

member of the board of PSTX.

PSTX provides the hardware in the Safety-Sponge

System at no cost to the hospital in exchange for an agreement to purchase the

Safety-Sponge disposable line of products. Previously the company sold this

equipment to Clients, but it realized that it is better off giving it away in

exchange for a royalty like cash-flow from the sale of its sponges. PSTX

maintains the title to the hardware, which distorts its income statement, as

the hardware needs to be depreciated over its estimated life (around 3 years).

How much is PSTX worth

This is a really good story, but now comes the

most important part, how much is PSTX really worth?

The company just came out with its 10-K. Below

is some data I collected.

The company posted a loss of $2.7Mn for the

year. But looking closer, you see that CFO turned positive and now stands at

$2.6Mn, an important mark.

There are two important items that I would like

to highlight: Depreciation and amortization of patents.

Depreciation is included in Cost of Revenue, and

almost all of it comes from the fact that PSTX provides the SurgiCounter

(hardware) at no cost to its new customer facilities. Because PSTX remains the

legal owner of the scanners, they have to be depreciated on PSTX's books

(average life is 3 yrs). Previously PSTX sold these scanners to Clients, which

meant its gross margin was higher. Even so, the company anticipates that as it

experiences a significant increase in revenues from the sale of sponges at

current pricing levels, the revenue growth will eventually help offset the

effects of a growing depreciation expense, resulting from scanners being

recorded as a cost of revenue.

The amortization of patents expense is there

because the patents have to be amortized over their original estimated useful

life, in this case 14.4 yrs. The patents have been valued at $4.7 million,

which means PSTX will record amortization expense of $325k per year until 2019.

It is important to note that this is a non-cash cost, as PSTX will not have to

pay the $325k per year.

Building a Run-Rate Model

Because the company has been growing very fast,

looking at its current statements masks the true potential of the company. To

estimate how much PSTX is worth I built a run-rate model where several

important inputs had to be estimated:

- Revenue: Revenue is a function of number of Hospitals using the Safety-Sponge System (# of Clients) and the Revenue per Client

- # of Clients: the number of hospitals adopting the system has been growing between 140% and 335% YoY in any of the past 10 quarters. If I plug a triple digit growth-rate into the model the valuation explodes, so I decided to tune down the growth rate to 15% per year (meaning YoY and not QoQ)

- Revenue per Client: The average quarterly revenue per hospital since 1Q10 has been $26.9k, which translates into $107.7k per year. I rounded it down to $90k. I also assumed that the revenue per hospital will grow at 2.5%/yr (inflation)

- Gross Margin: The gross margin for 2012 was 43%, down from 46% in 2011 and 50% in 2010. Because I'm slowing the implementation growth-rate I will assume gross margins of 45%, and an improvement of 1% per year, until they reach 50% in 2017

- Operating Costs

- R&D: this item increased from $107k in 2011 to $580k in 2012. I'm taking $580k as base and assuming a growth rate of 15% / yr

- Sales & Marketing: Here is where it gets tricky. There are fixed and variable Sales & Marketing expenses, where the variable costs are one-time costs related with implementing the system in new customers

- Variable Sales & Marketing: in the 2012 10-K management indicated that the one-time costs for 2011 and 2012 were $0.6 Mn and $2 Mn, respectively. This translates into $15.8k and $11.1k per new Client in 2011 and 2012, respectively. The big difference between the two should relate to the economies of scale from the number of implementations each year (180 in 2012 vs 38 in 2011). To be on the safe side I'm assuming that each new implementation will cost $16k

- Base or Fixed Sales & Marketing: This is calculated by subtracting the variable expense from the total expense, which comes at $2.9 Mn in 2012, which represents 12.4% of sales. Despite thinking that this expense will come down as a % of sales, as the customer base grows, for the model I fixed it at 14% of revenues

- General & Administrative: G&A was $4.1 Mn for 2012, up just 4% from 2011. I will give some room for error and assume that the base G&A is $4.3 Mn and that this grows at 7.5% (half of the assumed revenues growth)

- Preferred Dividends: Stable at $530k / yr. You could argue that the pref. shares will be converted into common stock someday, but for now I'm assuming that they will remain as they are

- Taxes: At December 31, 2012 the Company had federal and state net operating losses of $10 million and $8 million, respectively. So I'm assuming NO TAXES any time soon. You can view the model in the long term as EPS before taxes

Below is the result of these assumptions:

Note: 2012 is the current run-rate, but assumes

no new customers.

I feel comfortable with most of the inputs in

the model. The only thing that I really can't estimate is the diluted # of

Shares in future years, which will depend on a variety of factors that I can't

estimate. Therefore I'm keeping this input fixed.

Despite having reported a $2.7 Mn loss for 2012,

according to the model above the company should be profitable in the coming

years, and this profitability will grow significantly as the company adds

customers and economies of scale kick-in. Looking 3 or 4 years down the road,

the company looks much better, and its implied PE comes down significantly: 9x

for 2015, 6.7x for 2016 and only 5x for 2017. And remember that, according to

the estimations above, the addressable market in the US roughly $400Mn, which

means that the model assumes that by 2017 the company has "only"

doubled the number of hospitals it serves (market share of 14%). In other

words, I think the model is very conservative in the # of Clients it assumes.

Notes on the two Series of Preferred Stock:

- Series A has a cumulative 7% dividend and a conversion price of $4.44. Currently there are 10'950 Series A shares issued.

- Series B has a cumulative 7% dividend, which can either be paid in cash or in kind (meaning via issuance of more Series B pref. Shares). The company opted for the in kind payment in 2011 and 2012. The Series B is convertible at any time at the option of the holder into common stock at $0.75 (The shares automatically convert if the following conditions are satisfied: (1) the daily volume weighted average price of the common stock is equal to or in excess of $1.50 per share for all trading days during any 6-month period and (2) the number of shares traded during such period averages at least 50,000 shares of common stock per trading day. Also, the Series B Preferred automatically convert into common stock at the applicable conversion price if the operating income is positive for at least four consecutive fiscal quarters and the cumulative operating income during such four fiscal quarters is at least $5,000,000. Currently there are 70'425 Series B shares outstanding which can be converted into 9.4Mn common shares.

Final Thoughts

Usually I don't invest in

"one-product" companies that are still in the red, but PSTX really

sparked my interest. The company offers a very competitive solution to a very

real problem, there is pressure from Medicare/States for hospitals to adopt

retained-sponge prevention measures and the market for this type of products is

still far from being crowded. After capturing a customer the company stands to

make a royalty-like return that, which is a very attractive source of income.

It is difficult for me to put a price target on

the stock, just because it is difficult to estimate how many hospitals the

company will add each quarter/year. This is just one of those cases where the

answer is "it is worth more!".

I read a research note on PSTX where the company

is seen as an acquisition target. The analyst then selects a list of comparable

companies that were acquired between 2 and 8 times Sales (most close to 3

times) and says that an acceptable acquisition price would be around 4 times revenues,

which is the comparables' average. Applying this multiple to the 2012 run-rate

sales (not much different from the 2013 sales projection from the research

report) I estimated a target price of $ 2.68 (the report estimates $2.50 due to

a difference in estimated # of diluted shares in the end of 2013). I neither

agree nor disagree with his model, but prefer going with my own run-rate model.

Further Research

Below are some important aspects that I didn't

cover in this article.

- Both Cardinal and A Plus are shareholders of PSTX.

- Cardinal placed a $10Mn order for inventory that was executed between 2010 (89%) and 2011 (11%), this is why sales decrease from 2010 to 2011. If you are analyzing past statements, please take into consideration this one-time bump in sales. Cardinal hasn't' yet released this inventory, and PSTX is actually paying Cardinal a very small fee for it not release the inventory just yet (it could have a meaningful impact in PSTX's CF). In my model I disregard this, because I'm assuming that in a couple of years $10Mn in revenues will be the normal inventory Cardinal has to keep to serve PSTX's Clients.

- PSTX has just started a new "premium" co-branded "Made in USA" product line.

- There is an interesting article in USA "What Surgeons Leave Behind" that today covers the retained-sponge issue. There is also a research "Eliminating Retained Surgical Sponges" in the Journal on Quality and Patient Safety that spanned over multiple years and proves the Safety-Sponge System is highly reliable and cost effective. I recommend reading it.

Link to PSTX presentation at the 25th Annual Roth Conference 19/March/2013: http://irdirect.net/filings/viewer/index/812301/000121390013001189/1

Disclosure: I am long PSTX

Who's to say what the life of RFID will be before a technology is created to be able to tag instrumentation and other elements of surgical instruments used and accounted for on the surgical field. Can the company tag existing inventory versus the hospital having to purchase new inventory with RFID imbedded in the instrument? The surgical team still must perform a manual count regardless. This is where it becomes a time consuming issue with the ability to still have the human error factor.

ReplyDelete